For business owners, real estate investors, and other high-net-worth individuals who want to reduce their taxes...

Schedule your free tax review below.

Adam Ripperdan CPA

After years of working with large accounting firms servicing even larger corporations, Adam launched his own practice to help smaller businesses lower their taxes and enable them to invest in their business. With a robust tax planning background, he brought the “big firm” resources to the businesses that need it most, those who are often overlooked… the Dark Horse business.

During your call, Adam will review your situation to help:

Optimize Your Legal Entity Structure

Maximize Your Deductions

Navigate Retirement Account Options

Implement Legal Loopholes

Update You on Legislative Changes

Coordinate a Tax-Advantaged Wealth Plan

Plan for Exits and Capital Gains (even if years away)

Identify Niche-Specific Strategies

And much, much more!

Adam Ripperdan CPA

After years of working with large accounting firms servicing even larger corporations, Adam launched his own practice to help smaller businesses lower their taxes and enable them to invest in their business. With a robust tax planning background, he brought the “big firm” resources to the businesses that need it most, those who are often overlooked… the Dark Horse business.

Proactive vs Reactive Tax Advisory

Strategic tax advisory is proactive. Generic, low value tax advisory is reactive. We believe your CPA should be more organized and proactive than you when it comes to your taxes so that you're not the one pushing for tax saving strategies at the last minute. The success of the proactive approach hinges on a continual, two-way dialogue between CPA and client.

Proactive Advisory CPA –

Frequent Touch Points

A Proactive CPA communicates regularly with their client and collaborates with other professionals like a Dark Horse Private Wealth CFP to bring tax saving strategies to the table timely so that they can be acted upon before year-end.

Reactive CPA –

Limited /No Touch Points

A Reactive CPA isn't aware of your major financial and life events, nor changes in tax law that apply to you, because they are too overwhelmed preparing and filing tax returns for other clients due to chronic pricing and staffing issues.

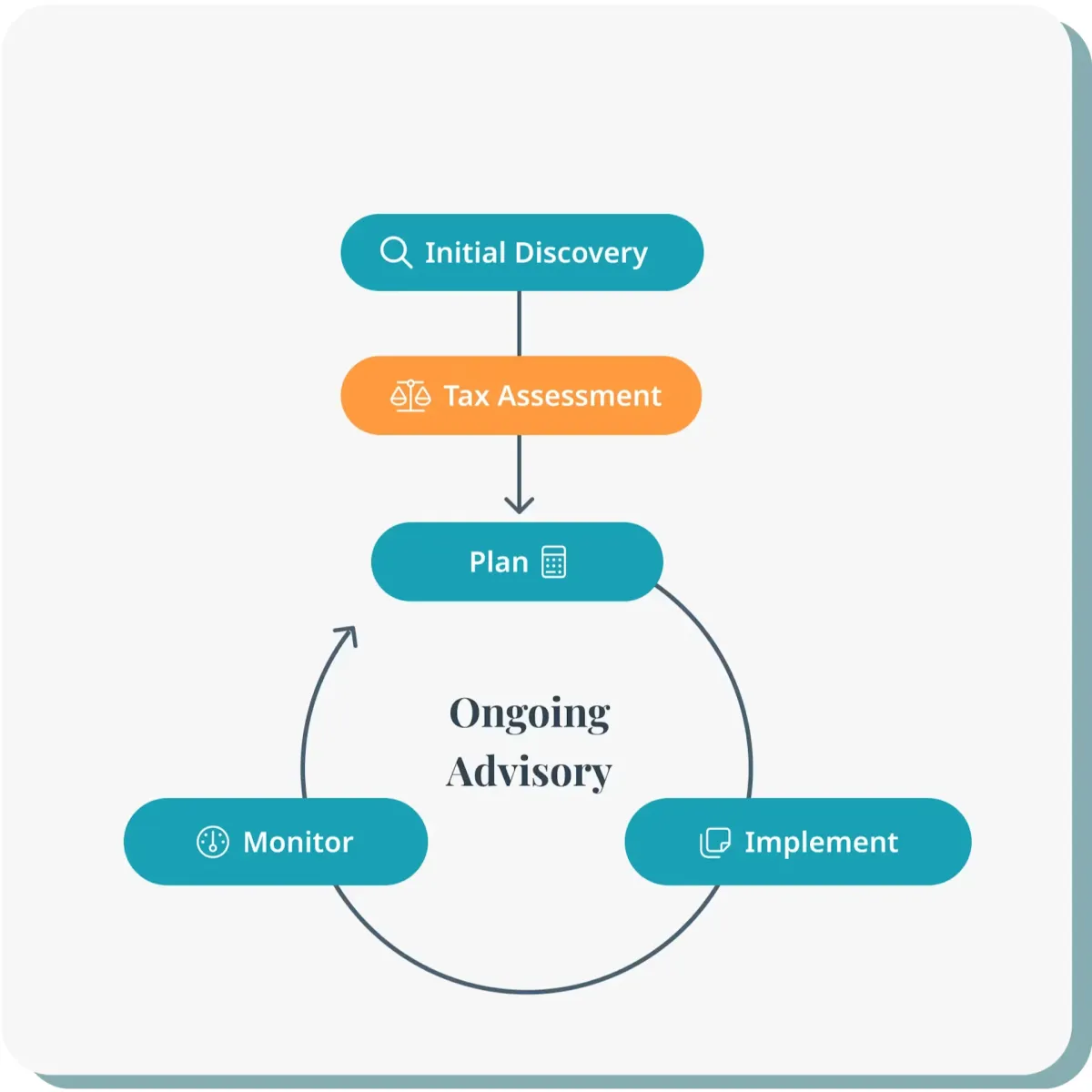

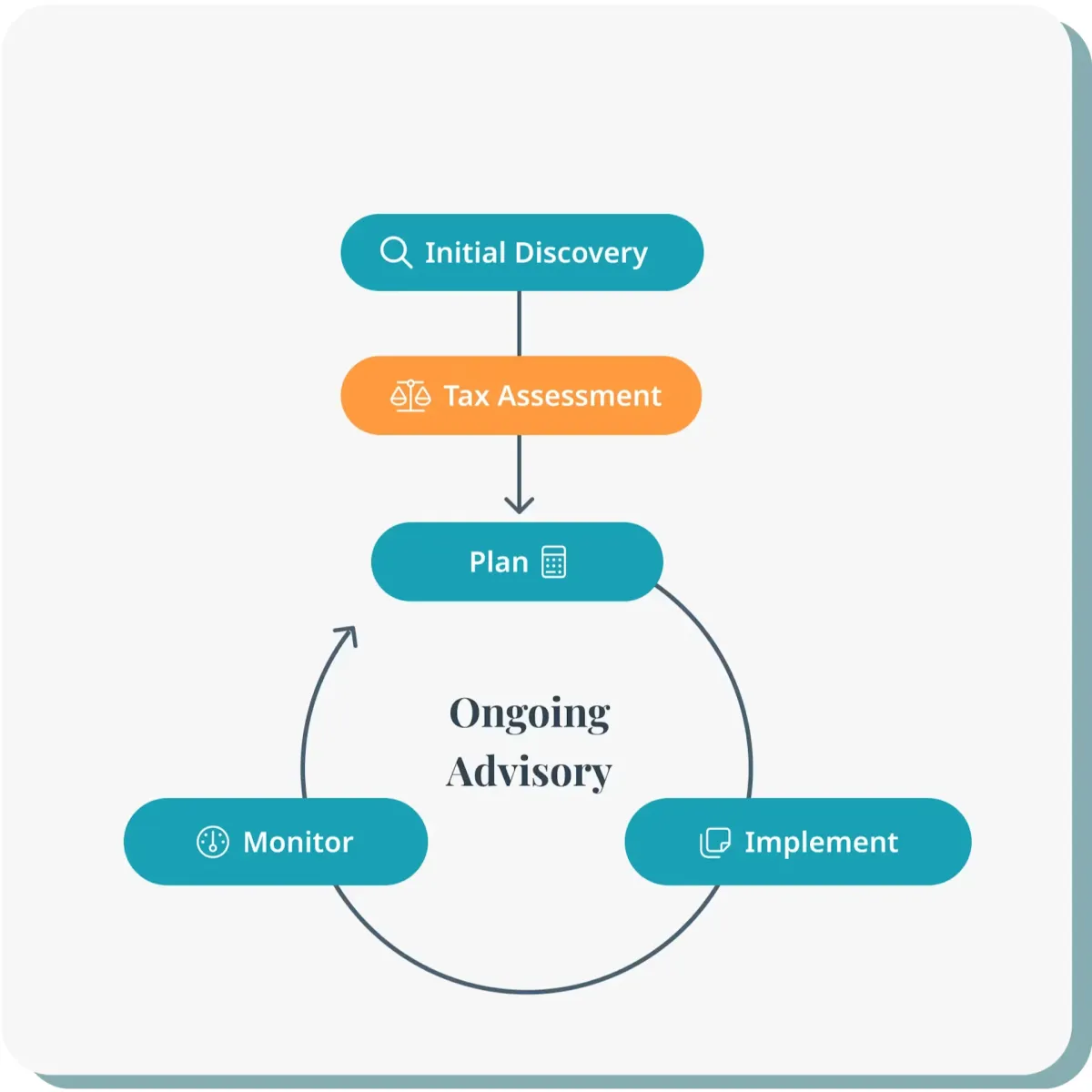

The Tax Advisory

3-Step Process

1. Initial Discovery. A meeting designed to gain a comprehensive understanding of your past and present tax situation as well as where you're headed.

2. Tax Assessment. Your CPA uses the info from the Initial Discovery to create a proposal of various relevant tax strategies and their corresponding impacts.

3. Plan, Implement & Monitor. We'll build a clear roadmap and timeline to execute on the chosen strategies, and ensure all parties understand their responsibilities. We'll continue to monitor for actionable changes in tax laws and your personal situation

The Tax Advisory

3-Step Process

1. Initial Discovery. A meeting designed to gain a comprehensive understanding of your past and present tax situation as well as where you're headed.

2. Tax Assessment. Your CPA uses the info from the Initial Discovery to create a proposal of various relevant tax strategies and their corresponding impacts.

3. Plan, Implement & Monitor. We'll build a clear roadmap and timeline to execute on the chosen strategies, and ensure all parties understand their responsibilities. We'll continue to monitor for actionable changes in tax laws and your personal situation

It's Gotta Pencil

We're not here to extract your tax savings through our fees. Rather, we believe it's important to understand how much you'll pay for various tax strategies compared to the expected tax savings. At the end of the day (or tax season), the money you invest in our strategic tax planning services will return net dollars to your pocket. For this reason, we not only display this expected ROI in our Tax Assessment, we'll also let you know what the actual results are come tax filing time.

It's Gotta Pencil

We're not here to extract your tax savings through our fees. Rather, we believe it's important to understand how much you'll pay for various tax strategies compared to the expected tax savings. At the end of the day (or tax season), the money you invest in our strategic tax planning services will return net dollars to your pocket. For this reason, we not only display this expected ROI in our Tax Assessment, we'll also let you know what the actual results are come tax filing time.

Your Plan In Action. Let’s Talk ROI.

Without Dark Horse

Context: client had a large real estate investment portfolio and spent over 50% of their time managing his properties.

Tax Year 2022: Owed $25,566 upon filing of tax return

Carried forward unallowed passive losses of $1,534,713

Problem: prior CPA never evaluated the situation to determine if there was a fact pattern to qualify for becoming a real estate professional.

With Dark Horse

Solution: during their Tax & Wealth Assessment, we discovered they qualified as a Real Estate Professional. Additionally, we advised the client to perform a Cost Segregation Study on all rental properties.

Tax Year 2022: Amended tax return and claimed $174,183 refund

Carried forward Net Operating Loss of $765,617 to tax year 2023, which saved $262,607 in Federal tax

*Each Tax strategy is unique and requires research into qualifying criteria to ensure we are taking a defensible stance. Results and savings also vary by client.

Without Dark Horse

Context: client had a large real estate investment portfolio and spent over 50% of their time managing his properties.

Tax Year 2022: Owed $25,566 upon filing of tax return

Carried forward unallowed passive losses of $1,534,713

Problem: prior CPA never evaluated the situation to determine if there was a fact pattern to qualify for becoming a real estate professional.

With Dark Horse

Solution: during their Tax & Wealth Assessment, we discovered they qualified as a Real Estate Professional. Additionally, we advised the client to perform a Cost Segregation Study on all rental properties.

Tax Year 2022: Amended tax return and claimed $174,183 refund

Carried forward Net Operating Loss of $765,617 to tax year 2023, which saved $262,607 in Federal tax

*Each Tax strategy is unique and requires research into qualifying criteria to ensure we are taking a defensible stance. Results and savings also vary by client.

Business Tax Advisory FAQs

What is Tax Strategy/Advisory and how can it benefit me or my business ?

Tax Advisory involves professional guidance on tax-related matters to ensure compliance, minimize tax liabilities, and take advantage of tax-saving opportunities. It benefits businesses by maximizing tax efficiencies and minimizing risks. Many tax strategies are unique to certain client situations and ensuring these strategies are correctly executed often requires deep expertise.

What is Tax Assessment ?

Many of our clients came to us from pre-existing CPA relationships. Making a change in your CPA is not something that happens frequently and people want to ensure that, if they are going to make a move, it is to the right place for a long-lasting relationship. The Tax Assessment is a way for Dark Horse to show you how we think, what we look for, and what the impact is to you before you decide to engage us to execute your customized strategy and file your tax return. It is also a great way to “spot-check” if your current provider is exploring all the tax strategies available to your particular situation without having to formally switch to a new accounting firm.

Do I have to do a Tax Assessment to become a Tax Advisory Client?

Yes, we perform a Tax Assessment for every advisory client. Think of it as your roadmap to success in our new partnership. We need to determine whether we can make a positive impact in your tax position and we both need to understand what it is going to take to execute and capture all the savings we outline. There are always exceptions, but the Tax Assessment is generally an excellent first step for our Advisory engagements.

How can tax Strategy/Advisory services help in reducing my tax liability?

Tax strategy services help identify deductions, credits, and incentives applicable to your business or your personal income sources. They also assist in structuring transactions and operations in a tax-efficient manner, with the end goal being a reduction in your overall tax liability.

What is the difference between Tax Deferral Strategy and Tax Reduction Strategy?

Tax Deferral strategies are focused on deferring or delaying your tax liability to some future point. A common example of a tax deferral strategy is a 1031 exchange (also known as a like-kind exchange) in real estate, where you can “defer” all or a portion of the gain on the sale of investment/rental real estate when you replace that property with another investment property within a certain time period of the sale, thereby deferring the tax liability associated with the deferred gain recognition. Tax Reduction strategies are meant to immediately reduce your tax burden for the current (and potentially future) tax years. A common example of a tax reduction strategy is making charitable contributions to qualifying charitable organizations, which can reduce taxes in a variety of ways, depending on your tax scenario, such as:Redirecting required minimum distributions (RMDs) from IRA accounts to be paid directly to a qualifying charitable organization of your choice (also known as making a QCD or Qualified Charitable Distribution), thereby directly reducing the taxable income reported for the year of the QCD.Reducing your state tax liability in states that allow for tax credits for contributions to certain charitable organizations designated by the state or states that allow for a reduction to your state taxable income for charitable contributions over a certain amount.Increasing your Federal itemized deductions, if over the standard deduction amount, thereby reducing your taxable income and your tax liability.

What is the difference between tax compliance and Tax Strategy/Advisory?

Tax compliance involves adhering to tax laws and filing accurate returns on time. Often, tax compliance is a reactive engagement, meaning your accountant is filing your tax return based on historical information. Tax Advisory, however, focuses on strategizing around your financial activities to minimize tax liabilities within the legal tax framework throughout the year. Through our advisory services, we are taking a proactive approach to make reasonable predictions regarding your tax liability based on certain strategies we can execute during the calendar year.

How do Tax Advisors stay updated with changing tax laws?

Tax advisors stay updated through continuous professional education, subscribing to tax journals, participating in industry seminars and conferences, and leveraging professional networks. This enables them to provide current and accurate advice every year. Often, tax law or code changes occur during elections shifts between parties and subsequently roll out over a 4 to 8 year period, with changes phasing in or out each year, so remaining connected to the ever-changing tax landscape through these avenues is vitally important.

What documents and information do I need to provide to a Tax Advisor?

You typically need to provide financial statements for any businesses you own/operate, previous tax returns, business plans, records of income and expenses, payroll information, and details of significant transactions. Specific requirements may vary based on the services required and your tax situation.

Are the fees for Tax Advisory services tax-deductible?

It depends. If related to a business or trust/estate, fees paid for tax advisory services are generally deductible. If related solely to your individual taxes, these fees are not typically deductible. However, consulting your tax advisor is vital to understanding the specific deductions applicable to your situation and is yet another area where we can help guide you in strategically minimizing your tax liability.

Get a personable & experienced CPA who will partner with you to proactively reduce your tax bill.

© 2024 Dark Horse CPAs. All Rights Reserved. Protected by copyright laws of the United States and treaties. This page may only be used pursuant to our Terms & Use Agreement and Privacy Policy. Any reproduction, copying, or redistribution (electronic or otherwise) in whole or in part is strictly prohibited without the express written permission of © 2024 Dark Horse CPAs.

© 2024 Dark Horse CPAs has achieved positive results for its clients, but because past performance is not a predictor of future success, you may have more or less success depending on many factors, including your background, experience, work ethic, client base, and market forces.

This site is not a part of the Facebook website or Facebook, Inc. or the Google website or Google, LLC or Alphabet Inc. Additionally, this website is NOT endorsed by Facebook in any way, or the Google website or Google, LLC. or Alphabet Inc. Facebook is a trademark of FACEBOOK, INC.